Collecting pledges in Salesforce NPSP

The term pledge can mean something different to every nonprofit organization. The majority of organizations equate pledges with a promised donations. This is contrasted with a recurring donation where there is no specific commitment.

For some, a pledge is a commitment to make a one-time gift and pay at a later date. Other organizations set up annual pledges for donors with installment payments throughout the year. Similarly, some organizations allow for longer-term pledges that are paid in installments over several years.

Each of these pledge types are dependent on how the organization handles its accounting and fundraising practices within their instance of Salesforce’s Nonprofit Success Pack (NPSP).

Nonprofits collect pledges in NPSP in a variety of ways

Things can get especially complicated around the competing needs of accounting and fundraising departments for calculating cash and accrual totals throughout the pledge process. The fundraising department may want to see donation totals increase only after each payment, while the accounting department may want to book the whole pledge revenue in the accounting period in which the pledge was made.

Luckily, NPSP allows for some flexibility around pledge models so that you can choose the system that works best for your organization. You have two main options for tracking pledges in NPSP.

Option #1: Use an accrual accounting method and the NPSP Payment object

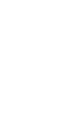

The first option is creating one Opportunity for the whole pledge amount and scheduling future payments with the Payment object. You’ll use this when your accounting and fundraising departments want the Opportunity to represent the full pledge amount and have it count towards a donor’s donation totals immediately. This is considered an ‘accrual’ model since the whole pledge amount will hit the donor’s gift totals when the opportunity is marked as closed-won.

In the accrual model, we're showing that the whole pledge amount hits the rollups at once, with the payments sitting below them and not affecting the rollups.

Pros of Option #1:

- Good for pledges where the total donation amount is declared up front

- Allows for solicitor credit for the whole pledge

- Works with most payment processors

Cons of Option #1:

- Not good for recurring donations where the roll-up amount for account/contact should increase with each paid payment

- Can’t assign solicitor credit at the individual payment level

- Can’t assign General Accounting Units (GAUs) allocation at the individual payment level

Option #2: Use a cash accounting method and the NPSP Recurring Donation object

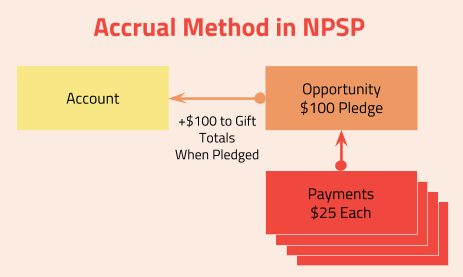

The second option within NPSP is to use the Recurring Donation object (and optionally rename that object to ‘Pledge’) to log the pledge total, then each payment installment can be represented by an Opportunity. You’ll use this when your accounting and fundraising departments want each opportunity payment to increase the donor’s donation totals when payment is received. This model is considered a ‘cash’ model because each installment will increase the donor’s gift totals when it’s paid.

In the cash model, each opportunity represents a payment and will individually affect the rollups. The recurring donation record sits above those opportunity payments representing the whole pledge and not affecting the rollups.

Pros of Option #2:

- Good for recurring donations where the total donation amount is not declared, only the installment amount

- Allows for different General Accounting Units (GAUs) allocation for each payment

- Allows for different solicitor credit for each payment

Cons of Option #2:

- Difficult to handle an “end date” - have to use installment number, which is clunky

- Not many payment processors will accommodate this model. (iATS Brickwork is the only known processor that can natively handle this.)

- Can’t assign solicitor credit to the whole pledge/recurring donation, only the individual installments

- The NPSP Recurring Donation object has some known bugs and limitations

Some organizations with more complex needs may need additional customization on top of these models. If you’re looking for more customization you should check out these five suggestions for extending NPSP from our friends at Soapbox Engage.

Integrating automatic payment solutions can also introduce more complexity. While NPSP is not an accounting platform, Salesforce can track various payment types. If you’re looking for a more in-depth view of how to track donations in NPSP, we suggest reading our article “Two options for tracking donations in NPSP”.