What is a subsidiary ledger? Why should your Salesforce CRM be one?

This guest post comes from Stu Manewith from Omatic Software.

It’s an age-old battle between nonprofit Development and Finance teams: the foot-soldiers having to marry and reconcile the numbers. Leaders very often have to mediate between the fundraisers and the accountants when it comes to counting – and accounting for – money raised.

The ongoing objective, of course, is the elusive ability to reconcile – so that numbers reported out by the fundraisers and the accountants correspond or, if they don’t, for there to be mutual and sensible understanding of why. The first step up that steep slope is understanding the best way to structure your fundraising CRM with respect to your accounting general ledger.

This essay discusses the best-practice of leveraging subsidiary ledgers, particularly for the recording, tracking, and reporting of fundraising revenue and related payments. Once we delve into the basics of what ‘subledgers’ are and how they are used, we will explore the effective utilization of your Salesforce system – or any fundraising CRM – as a subsidiary ledger, and how that structure can better support financial reconciliation between these two equally important nonprofit functions.

What is a subsidiary ledger?

I entered the workforce in the late 1980s, and had taken accounting classes before that as required for both my bachelor’s and master’s degrees in business. I learned accounting both in school and on-the-job using large columnar sheets of paper on which I manually created the ledgers, journals, and ‘T-accounts’ needed for school and work assignments.

Back then, accounting software in the nonprofit world was just emerging, and clunky, bulky mainframe computers with custom-built software were the norm for Development offices — that were technologically-forward-thinking and that could afford them.

So, pre-software, we actually used physical paper journals and ledgers. Ironically, using that ‘old school’ model is an effective way to explain what a subsidiary ledger (‘subledger’) is, and how subledgers are used in relation to the general ledger.

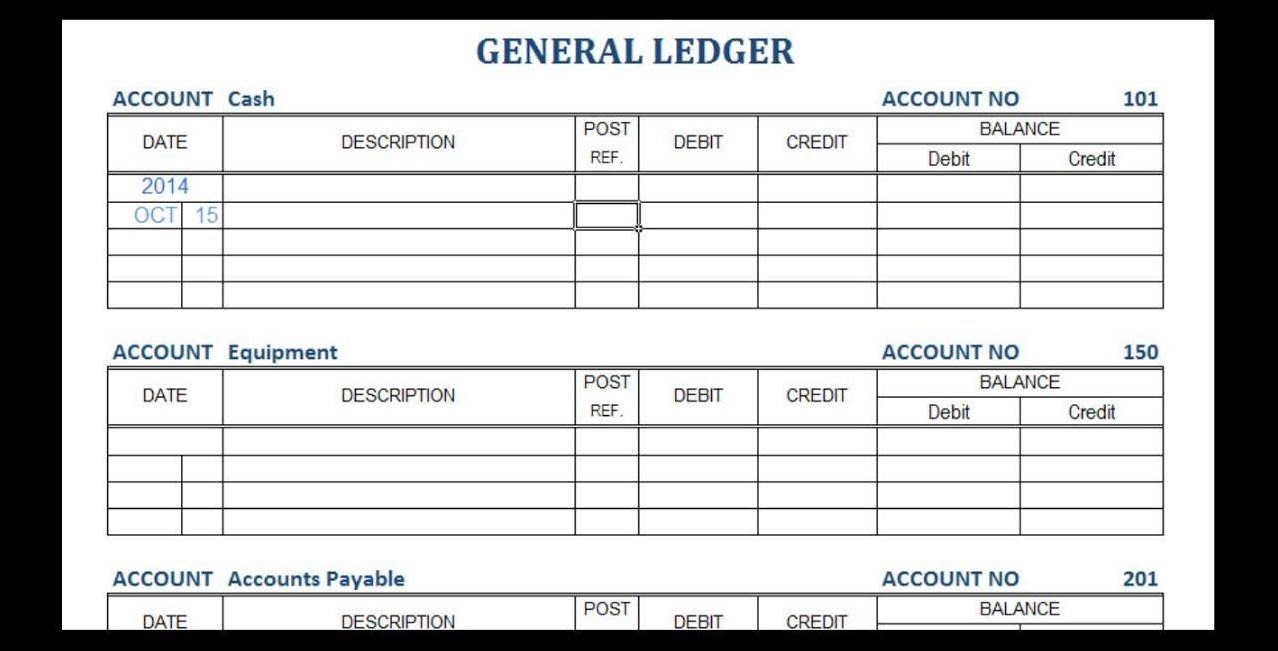

An organization’s general ledger (or ‘GL’) is the comprehensive system of record for an organization’s financial data. The GL is typically made up of accounts which track both the financial activity and the overall financial position (health) of the organization. Prior to software systems, the GL was a physical ledger (paper workbook) in which accountants and bookkeepers recorded transactions and calculated account balances.

The GL could include a huge amount of transactional data that could fill pages and pages of journal entries and thereby clutter the ledger with a lot of detail that could just as well be stored elsewhere. A subledger is that ‘elsewhere’. A subledger is where all of that detail is recorded and maintained so that only summary entries need be recorded in the GL. Again, back in the day, these were physical paper ledger worksheets. The totals from the subledger worksheets would be calculated and then transferred to the GL (literally copied into the GL by hand as journal entries).

The diagram below illustrates some of the common subledgers (in blue) used in typical nonprofit, as well as what they may be used for (green).

A simple example – your fundraising CRM as a subledger

Imagine an organization that receives only 10 gifts a day, so around 50 per week, and perhaps 2500 gifts per year. In this example, without a subledger, the finance team would have to record 20 transactions per day to record revenue from gifts (a debit line and credit line for each gift) or 100 transactions each week. (See Fig A)

However, if all of that detail is properly and effectively maintained in a subledger, the GL may record a daily summary – two transaction lines instead of 20 – or perhaps even a weekly summary – two lines instead of 100. (See Fig B)

(fig. A)

(fig. B)

It is critical that great care is taken to ensure that the detail in the subledger is always in agreement with the corresponding ‘control’ accounts in the GL. At any time, a subledger report of the detailed transactions and their totals for a particular date range should always be able to ‘tie’ to the corresponding accounts totals or balances in the GL for the same period.

Subledgers also stand on their own

One very useful feature of subledgers is that they can serve as a repository for imperative non-financial data and other information needed to run an organization. For example, the accounts payable (‘AP’) subledger is a place where all vendor information is maintained as well as data that pertains to how long an invoice has ‘aged’ and whether a vendor prefers to be paid electronically or by check. The GL doesn’t really ‘care’ about vendor information – the key financial data that the AP subledger passes to the GL is transactional: it has to do with which expenses have been attributed to which expense accounts, which expenses have been paid or are still to be paid, related dates, what the financial purpose of the payment was, and related transactional information.

Similarly, let’s assume you use Salesforce NPSP as your fundraising CRM: In addition to gift, pledge, and other revenue-related data, Salesforce will contain donors’ biographical information, contact history, prospect management and moves management activities, event participation, and the like. This data collection process can occur seamlessly if you’ve made full use of the various relevant apps and integrations available for Salesforce.

All of this collected data is fundamental and foundational for the Development team to successfully run its business, but the GL is typically only interested in key financial and transactional data having to do with properly and effectively recording revenue to the right accounts and in a timely fashion.

The days of paper ledger books are long gone and almost all of the recording, journaling, balancing, reconciling, and reporting is done today using sophisticated accounting and financial management software built especially for the nonprofit sector. Nevertheless, the concepts of the GL as the central repository of summary financial data, and the subledgers as the place where the details reside, remain fundamental to efficient financial management.

Should your Salesforce CRM be ‘subsidiary’ to the GL?

In many organizations that I’ve worked with, Development leadership and Finance leadership are – what? Intimated by each other? Distrustful of each other? Feel misunderstood or just don’t speak the same language? Perhaps a little of each. And, while team members truly want to be professionally respectful of their colleagues, and intentionally work toward the organization’s best interests, there is often a level of personal ownership that one side or the other feels they have to sacrifice that can lead to resentment and exacerbate the level of misunderstanding.

Just think about this example – which is pretty ‘textbook’:

At a board or committee meeting with lay leadership, Development reporting and Financial reporting do not correspond, and may even conflict. While this can make the organization’s staff look questionable overall, leaders typically tend to think that the finance side is more ‘correct’ — primarily due to accounting being perceived as more ‘black and white,’ while Development tends to be more fluid. In addition, accounting has been monitored and controlled as a profession for more than 130 years by respected organizations such as the AICPA and the FASB, while fundraising oversight has only been ‘a thing’ since the 1960s when the AFP was first formed. Finally, and most importantly, an organization’s financial reporting supports the information that is submitted to the federal government and informs whether an organization can maintain and sustain its tax-exemption.

The beauty of having your Salesforce system be a subsidiary ledger to the GL is that it ensures that generally accepted accounting controls are in place that affect the information relevant to both teams.

Those controls further ensure that the data between systems can always be reconciled, and that reporting is effectively understood by each team, as well as by other organizational stakeholders, including executives and volunteer leadership.

What it doesn’t mean is that Finance can have its hands in Development’s business or vice-versa. A subledger is in no way subordinate or inferior to the GL. It strictly means a place (ie, a data system in lieu of a physical paper ledger) where:

- transactional detail is recorded and maintained

- related business processes have been affected to ensure that the numbers between systems can be reconciled

- generally accepted accounting principles (‘GAAP’) are being followed

The Development team would – in fact, would have to – continue to own and manage all key functions of Salesforce – both financial and non-financial – and would have to collaborate with their Finance colleagues to ensure that the system is set up to transmit financial data to the GL in a way that ensures compliance with GAAP and reconcilability. Similarly, the Finance team would have to collaborate with their Development colleagues to ensure that the GL can effectively support the valid nuances associated with fundraising revenue. Some examples include long-term pledges and payment schedules, donor-imposed restrictions or conditions on gifts, gifts of property, and proper accounting for planned giving vehicles.

Accounting controls and fundraising controls

Both the Finance team and Development team will typically have controls in place that support efficiency, accuracy, ethical standards, regulation compliance, and other departmental objectives. An example of an accounting control is daily reconciliation between the accounts payable subledger and the GL. An example of fundraising control is routine monitoring to ensure donations have been used according to the donors’ intention. In both of these examples, corrective action may be required if the control procedure detects misalignment.

When your Salesforce system is set up as a subledger to the GL, both the Development team and the Finance team will benefit from the application of each others’ departmental controls. Here are few more examples:

Accounting controls that also benefit Development

- Accounting requires that all subledger activity is posted to the GL daily. Not only does this ensure that fundraising revenue is ‘booked’ in a timely fashion (so that interim financial reports accurately state fundraising revenue), but it also detects any discrepancies on a daily basis so that they can be investigated and rectified expediently, rather than having to pore over a week’s or a month’s worth of gift transactions to investigate multiple errors over a long period of time.

- Accounting puts a control in place that requires the pledge receivable account in the GL to be reconciled weekly against new pledges and payments on existing pledges recorded in Salesforce. From an accounting standpoint, this ensures that financial statements are accurate, even if on demand (as opposed to end-of-month). But from a fundraising standpoint, this is a beneficial extra check to ensure that new pledges were recorded correctly and that payments were properly applied – both to the right donor and as a proper pledge payment rather than as new gift revenue.

Development controls that also benefit Finance

- In the example above, we stated that Development routinely monitors program activity to ensure that donations are used in accordance with donor intent. This can provide tremendous ‘watch dog’ support to Finance, since Finance is ultimately accountable for disbursements but may not be aware of donor intent to the same extent that Development is. With the development team continually monitoring how donor-funds are being expended, an additional detective and/or corrective control is in place that will support both teams.

- Development puts a control in place to ensure proper documentation when donor-imposed conditions are met (or are substantially met), and that such documentation should be furnished to donors to demonstrate that the organization is both being transparent in its donor-communications and are also good stewards of the funds that have been conditionally donated. This documentation will serve the Finance team well so that dual effort does not have to be exerted in terms of detecting when donor-imposed conditions have been met, and revenue can be recognized as expediently as possible.

It’s important to note that today’s systems and the technology that supports them allow many of these controls to be automated, including proactively alerting teams when something is out of sync. Modern systems also have tools that allow reconciliation to be monitored and confirmed as often as is desired.

The top seven reasons for integrating Salesforce (or any fundraising CRM) with your accounting GL system

In addition to the discussion above, below are the ‘top seven’ tactical benefits that come from integrating Salesforce (or any fundraising CRM system) as a subledger of your Finance team’s GL.

- Eliminates duplicate data entry effort

- Reduces / eliminates opportunity for data entry errors

- Allows Finance to remain in control of organizational financial recording and reporting, while Development remains in control of fundraising recording and reporting; but still ensures that systems can be easily aligned to each other to explain what might appear as discrepancies to the unschooled eye

- Allows most if not all fundraising transactional detail to remain in Salesforce (ie, the subledger) so that the GL does not get unnecessarily cluttered

- Ensures ongoing reconciliation between systems and reduces opportunities for systems to be out of sync

- Ensures common understanding and reasonable alignment when Development numbers reported are not consistent with Financial reporting

- Provides / ensures the opportunity for better and more empathetic collaboration between the Finance and Development teams. Further, the results of integration – a fully-aligned pair of co-equal systems – will drive improved transparency, insights, operations, and, ultimately, accountability for delivering your mission.

Outcomes and conclusion

While saving time, reducing errors, optimizing the GL, and improved collaboration are great outcomes – and real efficiency outcomes regardless of how ‘great’ they are – the highlight of having your Salesforce system structured as a subledger to your GL is the reconcilability.

Ongoing reconciliation between the Salesforce subledger and the GL will, fundamentally, ensure that funds raised match revenue recorded as fundraising from period to period. And, being able to prevent, detect, and quickly correct discrepancies and inconsistencies between systems on an ongoing basis, and especially before conflicting reports are published, promotes an organization’s competence, transparency, accountability, and overall credibility – both to financial decision-makers and to donors.

Structure and nomenclature aside, however, it needs to be restated: while Salesforce may be a subsidiary ledger to the GL for financial recording and reporting purposes (and while Salesforce is doing a great service to the GL by maintaining so much of this detail), Salesforce itself is one of the organization’s main systems of record, and stands on its own, along with the GL as a core repository of essential organizational information.

About the author

Stu Manewith joined Omatic Software five years ago and serves as the company’s Nonprofit Advocacy Director. In that role, he is Omatic’s nonprofit sector domain specialist and subject-matter expert and is responsible for actively promoting and demonstrating Omatic’s position as the nonprofit industry’s leading partner in the areas of data health and integration.

Prior to Omatic, Stu spent 13 years at Blackbaud, working with Raiser’s Edge, Financial Edge, and Blackbaud CRM client organizations as a consultant, solution architect, and practice manager.

Previously, Stu spent the first part of his career as a nonprofit executive, fundraiser, and finance director, working in both the healthcare and arts/cultural arenas of the nonprofit sector. He holds business degrees from Washington University and the University of Wisconsin, and he earned his CFRE credential in 1999.

Looking for more Salesforce content?

Sign up for our monthly newsletter to receive the latest Salesforce news, tips, and tricks in your inbox.